Allstate Auto Insurance Review, 2024 – In Good Hands?

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

What is Allstate auto insurance?

- Collision coverage

- Comprehensive coverage

- Liability coverage

- Medical payments coverage

- Uninsured and underinsured motorist coverage

- Personal injury protection

- Custom equipment coverages

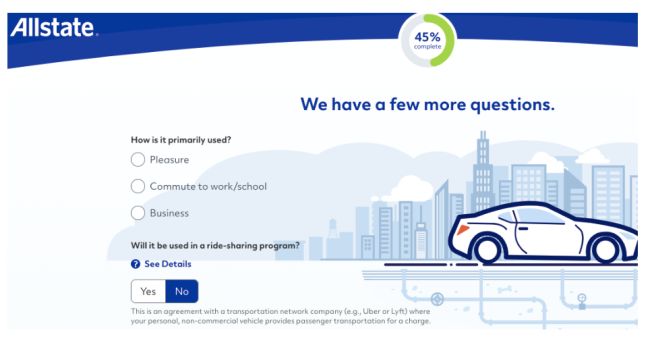

- Rideshare insurance

- Personal umbrella policy

- Rental reimbursement coverage

- Classic car insurance

- Mexico travel car insurance

- Roadside assistance plan

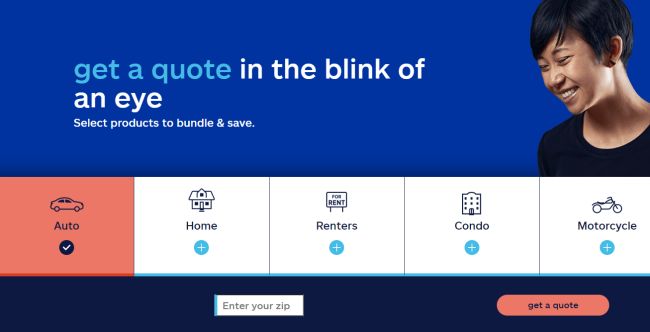

- Save up to $610 Per Year on Car Insurance

- See Quotes in Minutes

- Compare 30+ Insurance Providers

- Switch Online or Speak to a Licensed Agent

- No Fees to Check Rates, Ever

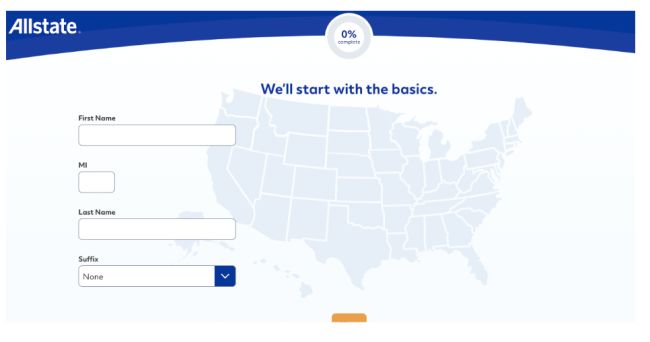

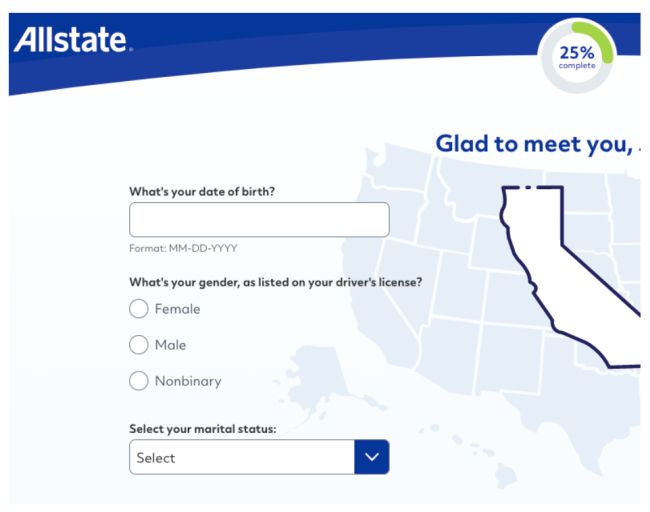

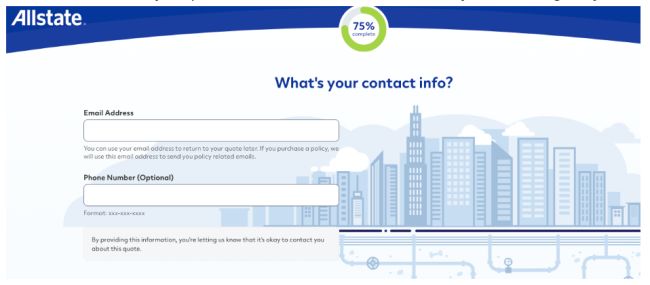

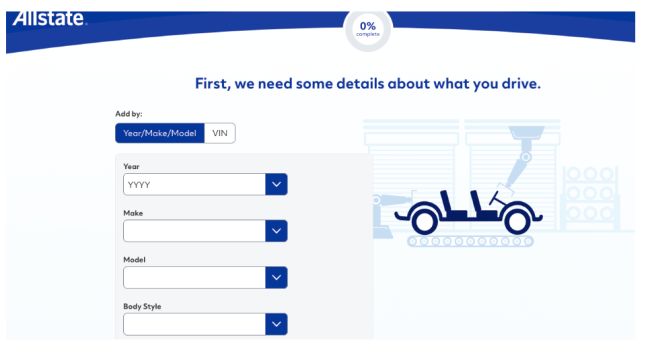

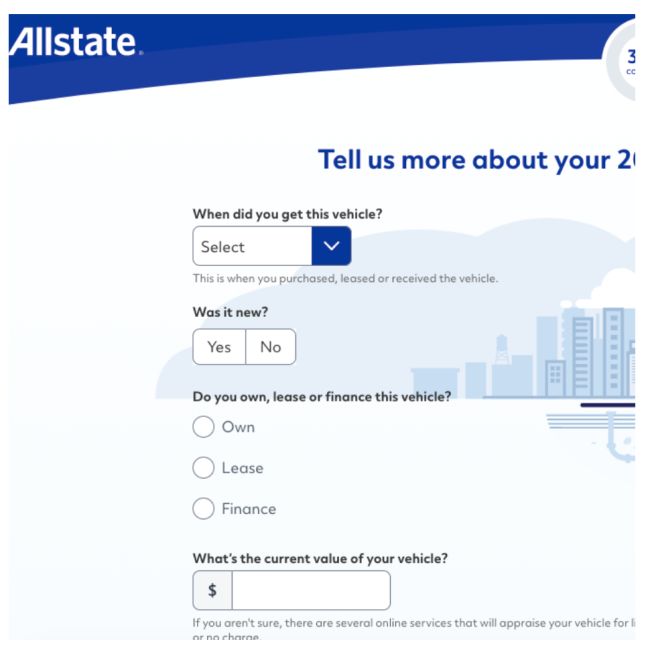

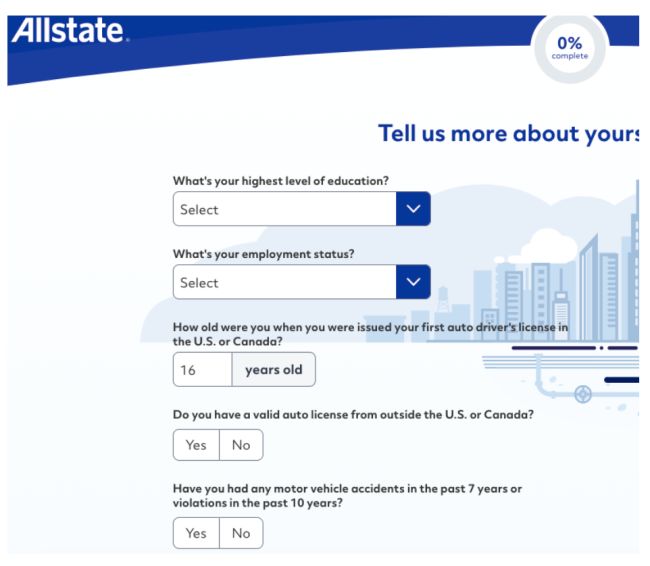

How does Allstate auto insurance work?

How much does Allstate insurance cost?

- Bodily injury limits: Ranged between $100,000 and $300,000 per person, per accident

- Property damage limit: $20,000

- Uninsured/underinsured motorists bodily injury: Between $100,000 and $300,000 per person, per accident

- Comprehensive coverage and deductibles: $500

- Collision coverage and deductibles: $500

Allstate auto insurance discounts

- Anti-lock brake: Your premium may fall if your car has anti-lock brakes. All modern cars have this functionality.

- Anti-theft device: If your car has an anti-theft device installed, you may have to pay less.

- Multiple policy discount: This allows you to save on your auto insurance when you have multiple policies with Allstate.

- Early signing: You can save money if you sign your policy seven or more days before it goes into effect.

- Responsible payer: This is applicable if you have not received a cancellation notice for non-payment in the past year.

- New car: If your car is a current model year or one year prior and you're the first owner.

- EZ pay plan: When you set up automatic withdrawal for paying your premium.

- FullPay: If you pay your policy in full.

- Smart student: If you're unmarried and under 25, you can save if you meet certain conditions.

- Safe driving: Allstate's Drivewise rewards policyholders for practicing safe driving habits, speeds, stops, hours, and low mileage. Milewise is based on the miles you drive; there's a daily base rate plus a per-mile rate.

- Save up to $610 Per Year on Car Insurance

- See Quotes in Minutes

- Compare 30+ Insurance Providers

- Switch Online or Speak to a Licensed Agent

- No Fees to Check Rates, Ever

Allstate auto insurance features

Allstate Rewards

Deductible Rewards

New car replacement

Accident forgiveness

Safe driving bonus

Who is Allstate auto insurance best for?

- People with unique needs: Allstate offers car and classic car insurance if traveling to Mexico.

- Rideshare drivers: If you drive for Uber, Lyft, or other rideshare companies, Allstate's got you covered.

- Safe and low-mileage drivers: Allstate's Drivewise rewards policyholders for practicing safe driving habits. Milewise charges you based on the miles you drive.

Pros and cons

- Lots of coverage options to choose from.

- Allstate offers rideshare insurance in many states.

- Rewards safe-driving habits.

- Poor customer satisfaction.

- Policies are sold in six-month terms.

- Roadside support comes at an additional cost.

- Save up to $610 Per Year on Car Insurance

- See Quotes in Minutes

- Compare 30+ Insurance Providers

- Switch Online or Speak to a Licensed Agent

- No Fees to Check Rates, Ever

Allstate vs. competitors

Insurer | JD Power 2023 Auto Claim Satisfaction Rating* | Rideshare coverage |

Allstate | 882 | Yes |

Amica | 909 | No |

Geico | 871 | No |

State Farm | 891 | Yes |

Nationwide | 875 | No |

Geico

State Farm

Nationwide

FAQs

- Save up to $610 Per Year on Car Insurance

- See Quotes in Minutes

- Compare 30+ Insurance Providers

- Switch Online or Speak to a Licensed Agent

- No Fees to Check Rates, Ever

The bottom line

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Jasir Jawaid is Joy Wallet's Assistant Editor. He has more than 13 years of experience as a journalist covering Wall Street, equities, financial policy and regulation, and cryptocurrency and blockchain.